ManpowerGroup Employment Outlook Survey Q3 2024

More and more firms are planning to expand their workforce again as the economy recovers

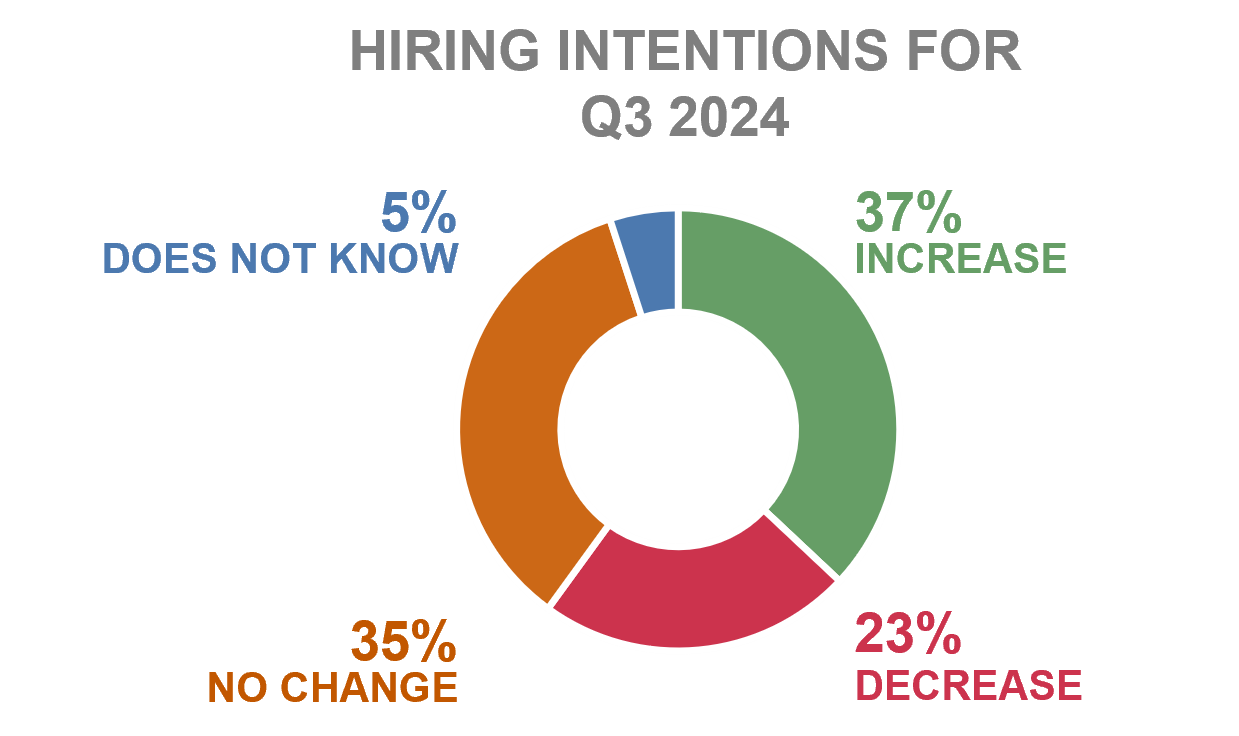

In the third quarter of 2024, 37% of domestic employers plan to expand their current workforce. This is 6 percentage points higher than three months earlier. Above-average hiring is expected to take place on the Great Plain and at firms operating in Budapest during this period.

ManpowerGroup conducted its quarterly survey of more than 40,000 employers in 42 countries around the world, asking a representative sample of 525 employers in Hungary about their hiring intentions for the third quarter of 2024.

23 percent of employers expect downsizing in the coming months, resulting in a seasonally adjusted Net Employment Outlook (NEO) or +14 percent, derived from the responses, which is 5 percentage points higher compared to the previous quarter and a slight year-on-year increase of 1 percentage point.

"According to our latest data, domestic businesses are confident that the economy, which has recently recovered from the recession, will continue to grow," said Tamás Fehér, Managing Director of Manpower Hungary, Croatia and Slovenia. - Nevertheless, the positive outlook is far from unanimous: there are big differences in the outlook both by region and by sector."

The 14% increase is an average figure, with significant differences between regions of the country. Employers' expectations are above the national average in the Northern Great Plain (NEO: +26%), the Southern Great Plain (+23%) and Budapest (+17%), while in Central Hungary (+11%) the increase is slightly below average and in the Western regions (+5-6%) only a slight increase is expected. The region of Northern Hungary (-11%) is a negative exception in this period, with far more employers forecasting layoffs than hiring.

There is also considerable variation by sector, with the biggest growth is expected in Consumer Goods and Services (NEO: +36%) sector, followed by Healthcare and Life Sciences (+26%), Energy and Utilities (+22%) and Transport, Logistics and Automotive (+22%). Industrials and Materials industry (+13%) reported an average increase in their workforce, while in other sectors the outlook is much more modest.

By company size, we can see that this quarter, companies under 1,000 employees are more optimistic, with respondents predicting stagnation or decline in larger companies.

Globally, the employment outlook remained broadly unchanged compared to the previous quarter. The indicator remains at a very high level of 22%. Among the 42 countries surveyed, only three expect a situation of near stagnation: Romania (+3%), Argentina (+3%) and Israel (+4%). In Europe, expectations are somewhat below the global average, Switzerland wishes to expand their workforce the most (NEO: 34%), followed by the Netherlands (28%) and Belgium (25%). Outside Europe, employers in Central America - Costa Rica (35%), Guatemala (32%), Mexico (32%) -, the US (30%) and India (30%) are the countries where employers expect the largest increases.

This time, the variable part of the survey asked, among other things, to what extent respondents use new technologies (artificial intelligence (AI), machine learning, virtual reality) in their own companies. Responses from domestic firms show that, depending on the technology, between 9 and 11 percent of firms consider themselves early adopters and are already taking full advantage of the benefits of these technologies, 26-28 percent are currently implementing them and a further 20-22 percent indicate that they will do so within a year. Of course, for the majority, AI adoption is a major challenge. Among these challenges, high investment costs (32%), lack of employee skills (30%), data protection and compliance (29%) and lack of appropriate tools (27%) were the most cited.

We also surveyed what they considered to be the most common challenges for younger workers with less than 10 years' experience. 42 percent of employers listed high salary expectations, 34 percent cited a lack of motivation and commitment, 33 percent referred to work-life balance expectations, while 31 percent chose recruitment and retention difficulties.